Visa card enhancement

Rokel Commercial Bank (RCBank) has enhanced its product and service offerings with the introduction of a suite of innovative Visa card services, part of its broader digitalization initiative. These services include:

Ø Visa Prepaid Card: This reloadable card can be used by both account holders and non-account holders. It is denominated in Leones and designed to promote financial inclusion by reaching out to individuals currently excluded from the formal banking system.

Ø Debit Visa Classic Card: Linked directly to the customer's RCBank account, this card allows for transactions that reflect immediately in the account. It is accepted both locally and internationally at Visa-enabled ATMs, POS terminals, and online platforms, providing customers with more convenience in accessing their funds globally.

These Visa card

services are part of RCBank’s broader electronic banking portfolio, which also

includes cardless ATM transactions, international remittances via MoneyGram,

Western Union, and RIA, as well as the Simkorpor mobile money platform. The

bank’s efforts are aimed at providing modern, safe, and efficient banking

services, enhancing customer experiences while promoting financial inclusion in

Sierra Leone.

Money Gram

Rokel Commercial Bank (RCBank) offers MoneyGram as part of its international remittance services, allowing customers to send and receive money globally. This service is aimed at providing a fast, secure, and convenient way for individuals to transfer funds to and from Sierra Leone. MoneyGram, along with Western Union and RIA, is integrated into RCBank's electronic banking services to facilitate financial transactions for both account holders and non-account holders.

MoneyGram through RCBank ensures that beneficiaries can collect their funds at any of the bank’s branches. This service is particularly helpful for people without access to traditional bank accounts, as it allows for easier and quicker access to international remittances.

These remittance

services are part of the bank’s ongoing efforts to expand its digital and

financial services to promote financial inclusion and streamline access to

global financial networks

Western Union

Rokel Commercial Bank (RCBank) offers **Western Union** as one of its international remittance services, which allows customers to send and receive money from around the world. This service is designed to provide a fast, reliable, and secure way for individuals to transfer funds across borders, especially for those who may not have formal bank accounts.

Key aspects of RCBank’s Western Union service include:

- Accessibility: Both account holders and non-account holders can use this service, making it widely accessible to the public.

- Convenience: Customers can receive their money at any RCBank branch, adding convenience for recipients.

- Speed: Funds are transferred quickly, often available for collection within minutes, depending on the location and transfer details.

This remittance

service is part of RCBank's broader strategy to promote financial inclusion,

providing easy access to international financial services for the Sierra

Leonean population

RIA

Rokel Commercial Bank (RCBank) offers RIA as part of its international remittance services, alongside MoneyGram and Western Union. The RIA service allows customers to send and receive money globally, providing a fast, secure, and affordable way to transfer funds to Sierra Leone from various countries.

Key features of the RIA service at RCBank include:

- Wide accessibility: RIA remittances can be accessed by both account holders and non-account holders, ensuring a broad reach to customers who may not have traditional banking services.

- Convenient collection: Recipients can pick up their funds at any RCBank branch, offering ease of access across the country.

- Competitive fees: RIA is known for its affordable fees, making it a cost-effective option for people looking to send money internationally.

By integrating RIA into its electronic banking services, RCBank is furthering its commitment to providing modern and efficient banking solutions, with a focus on financial inclusion and expanding access to global financial networks.

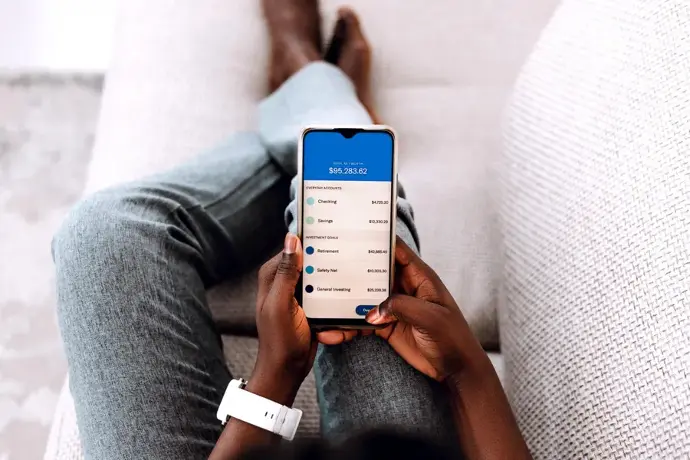

Internet and SMS Banking

Access to account information: Customers can view their account balances, transaction history, and other account details through a secure online platform.

- Fund transfers: The service allows users to transfer funds between RCBank accounts or to other banks.

- Bill payments: Customers can pay utility bills and other service fees directly online.

- 24/7 availability: Internet banking is accessible at any time, providing flexibility and convenience.

2. SMS Banking:

- Balance inquiries: Customers can check their account balances by sending a simple SMS.

- Mini statements: Users can request a mini statement of recent transactions via SMS.

- Transaction alerts: The service provides real-time notifications about account activity, including deposits and withdrawals, enhancing security.

These services are aimed at enhancing customer convenience by offering more flexible ways to manage accounts without the need to visit a physical branch, part of RCBank's broader push towards digitalization.

SMS Banking

- Balance inquiries: Customers can check their account balances by sending a simple SMS.

- Mini statements: Users can request a mini statement of recent transactions via SMS.

- Transaction alerts: The service provides real-time notifications about account activity, including deposits and withdrawals, enhancing security.

These services are aimed at enhancing customer convenience by offering more flexible ways to manage accounts without the need to visit a physical branch, part of RCBank's broader push towards digitalization.

Visa ATM and Point on Sale Terminals

Rokel Commercial Bank (RCBank) offers Visa-enabled ATM and Point of Sale (POS) terminals as part of its modernized banking services. These facilities provide customers with greater convenience for accessing and managing their funds.

Ø Visa ATM Services:

- Cash Withdrawals: Customers can withdraw cash from their RCBank accounts using Visa-enabled ATMs both locally and internationally.

- Account Access: Visa ATMs allow for easy access to account balances and transaction history.

- Cardless Transactions: RCBank has introduced cardless ATM transactions, enabling customers to make withdrawals without needing a physical card.

Ø Point of Sale (POS) Terminals:

- In-Store Payments: Customers can use their Visa cards to make payments at retail outlets equipped with POS terminals, providing a cashless transaction option.

- International Usage: RCBank’s Visa cards and POS terminals are compatible with global Visa systems, allowing for seamless transactions both locally and internationally.

- Secure Transactions: Payments through POS terminals are encrypted and secure, ensuring customer data protection.

These services are part of RCBank’s broader digitalization effort, aimed at improving customer experiences by offering fast, reliable, and secure banking options.

Investment banking

Rokel Commercial Bank (RCBank) provides Investment Banking services aimed at assisting individuals, corporations, and institutions with capital management, investment strategies, and financial growth. The bank's investment banking services typically focus on:

Ø Capital Raising: RCBank helps businesses and organizations raise capital through equity, debt, or hybrid securities, enabling them to fund expansion, new projects, or other financial needs.

Ø Advisory Services: The bank offers financial advisory services, including mergers and acquisitions (M&A), corporate restructuring, and investment strategy advice to ensure businesses make informed financial decisions.

Ø Portfolio Management: RCBank provides tailored portfolio management services, helping clients manage their investments to maximize returns and achieve their financial goals.

Ø Securities Trading: The bank may facilitate the buying and selling of stocks, bonds, and other financial instruments, helping investors capitalize on market opportunities.

By offering these services, RCBank aims to support both corporate and individual clients in maximizing their financial potential, making informed investments, and ensuring long-term growth.

Fixed Deposits

Rokel Commercial Bank (RCBank) offers **Fixed Deposit Accounts** as part of its savings and investment options, providing customers with a secure way to earn interest on their funds over a fixed period.

Key Features of Fixed Deposits at RCBank:

Ø Guaranteed Returns: Customers earn a predetermined interest rate, which remains fixed for the entire term of the deposit, offering a stable and predictable return on their investment.

Ø Flexible Tenure: RCBank offers a variety of fixed deposit terms, allowing customers to choose a deposit period that fits their financial needs—typically ranging from short to medium-term durations.

Ø Higher Interest Rates: Fixed deposits usually provide higher interest rates compared to regular savings accounts, encouraging longer-term saving.

Ø Security: Since the funds are locked in for the agreed term, it’s a safe investment option for customers looking for secure and risk-free growth of their money.

Ø Minimum Deposit Requirement: There is usually a minimum deposit amount required to open a fixed deposit account, ensuring the service caters to both individual and corporate clients with varying capital needs.

R C Bank’s Fixed Deposit service helps customers achieve their financial goals by offering a safe way to grow their savings over a set time period, with the benefit of competitive interest rates.

Rokel Special Deposits

Rokel Commercial Bank offers a product called **Rokel Special Deposits**, which is tailored for customers seeking higher interest rates and flexible terms for their savings. Here are some key features and details about this service:

Ø Higher Interest Rates: Special Deposits typically offer competitive interest rates compared to regular savings accounts. This can be particularly attractive for customers looking to grow their savings over a fixed term.

Ø Flexible Tenures: Customers can choose from various tenures for their deposits, allowing them to select a period that suits their financial goals and needs.

Ø Minimum Deposit Requirement: There is often a minimum amount required to open a Special Deposit account, which may vary depending on the bank's policies.

Ø Withdrawal Terms: Special Deposits may come with specific terms regarding withdrawals, such as penalties for early withdrawal. It's essential for customers to be aware of these conditions before opening an account.

Ø Financial Planning: This product can be an effective tool for long-term financial planning, helping individuals save for future expenses like education, home purchases, or retirement.

Rokel Commercial Bank's Special Deposits are designed to encourage saving while providing a secure way to earn interest. For more detailed information about specific rates, terms, and how to apply, you can visit their official site or contact the bank directly.

Rokel Sim Korpor Plus

Rokel Sim Korpor Plus is a mobile banking platform offered by Rokel Commercial Bank, designed to enhance financial inclusion and convenience for customers in Sierra Leone. This service allows users to conduct various banking transactions directly from their smartphones or basic mobile devices, helping to reduce the need for physical visits to bank branches.

Key Features:

Ø Transaction Capabilities: Users can perform a range of transactions, including deposits, withdrawals, fund transfers, bill payments, and e-cheque transactions. The platform also supports payments via QR codes, which can be used at various merchants like supermarkets, restaurants, and hospitals.

Ø Accessibility: The service is accessible via an app available on the Google Play Store and is compatible with basic phones that can accept a microprocessor SIM card. This makes banking services available to a broader audience, including those without access to traditional banking infrastructure.

Ø Security Measures: The platform incorporates strong security protocols, including two-factor authentication and end-to-end encryption, ensuring that user transactions are safe and secure.

Ø Customer-Centric Approach: Rokel Commercial Bank emphasizes a customer-centric approach, tailoring its services to meet the needs of various demographics, including low-income individuals and the unbanked population. The platform is part of the bank's strategy to foster financial inclusion and reduce transaction costs for users.

Ø Agency Banking: With over 200 agency banking locations across the country, the Sim Korpor Plus service aims to facilitate easy access to banking services for customers, especially in areas with limited banking facilities.

Overall, the Rokel Sim Korpor Plus service represents a significant advancement in digital banking in Sierra Leone, offering greater convenience and accessibility to financial services for the population.

Rokel Korpor Card

The Rokel Korpor Card from Rokel Commercial Bank is a product designed for both individuals and businesses, facilitating convenient access to banking services. Here are some key features and benefits:

Ø Accessibility: The card is accessible to both account holders and non-account holders, making it a versatile option for users in Sierra Leone. This inclusivity helps reach those previously excluded from the formal financial system.

Ø Usage: The Rokel Korpor Card can be utilized for various transactions, including both local and international payments at any VISA-enabled ATM or Point of Sale (POS) terminal. This feature allows users to make transactions easily and securely, enhancing their purchasing capabilities.

Ø Digital Banking Integration: It is linked with Rokel’s digital banking services, allowing cardholders to manage their accounts and conduct transactions via the Rokel Sim Korpor app. This app provides features such as 24/7 account access, fund transfers, and bill payments.

Ø Security Features: The card comes with advanced security measures to protect user information and transactions. These include encryption and secure login protocols, ensuring customer data is safeguarded against potential fraud.

Ø Cost Structure: There are various fees associated with the card, including maintenance fees, withdrawal charges, and international transaction fees. Users are encouraged to check with the bank for specific fee details.

The Rokel Korpor Card represents Rokel Commercial Bank's commitment to enhancing digital banking and making financial services more accessible to a broader audience. For more information, you can visit the bank's official website.

Current Account

The Current Account offered by Rokel Commercial Bank (RCB) is designed to facilitate convenient and flexible banking for both individuals and businesses. Here are the key features and services associated with this product:

1. Account Management: The Current Account provides customers with easy access to their funds through various channels, including ATM withdrawals, online banking, and mobile banking services. This allows for seamless transaction management and quick access to funds.

2. Withdrawal and Deposit Flexibility: Customers can make unlimited withdrawals and deposits, making this account suitable for those who need frequent access to their funds for daily transactions or business operations.

3. Debit Card Access: The account comes with a debit card that enables customers to make purchases at points of sale and withdraw cash from ATMs. This card is typically linked directly to the current account, ensuring that all transactions are reflected in real-time.

4. Online and SMS Banking: RCB offers online banking services that allow customers to manage their accounts, view transaction history, and conduct transfers easily. SMS banking services further enhance accessibility, allowing account holders to receive alerts and perform basic transactions via text.

5. Competitive

Features: The account is tailored to meet the needs of modern banking customers,

incorporating features that align with global banking trends, such as digital

transactions and robust security measures to protect customer data and funds.

Savings Account

The Savings Account offered by Rokel Commercial Bank provides customers with a flexible way to save money while earning interest on their deposits. Here are some key features of this product:

1. Interest Earnings: Customers can earn competitive interest rates on their savings, helping their money grow over time.

2. Access to Funds: The account allows for easy access to funds, enabling customers to withdraw or transfer money when needed, which is particularly useful for emergencies or planned expenses.

3. Low Minimum Balance Requirement: The Savings Account typically has a low minimum balance requirement, making it accessible to a wider range of customers, including those who may not have significant savings to start with.

4. Account Management: Customers can manage their accounts easily through various banking channels, including internet banking and mobile apps, which enhances the convenience of managing finances.

5. Financial Planning: This account is also designed to help customers save for future needs, be it for education, home purchase, or other significant life events, aligning with their financial goals.

Rokel Instant

The Rokel Instant service from Rokel Commercial Bank is designed to facilitate quick and efficient financial transactions. It primarily focuses on instant fund transfers, allowing customers to send and receive money seamlessly through their online banking or mobile app. Here are some key features:

1. Instant Transfers: Users can perform instant money transfers 24/7, whether to other Rokel accounts or to accounts at different banks, enhancing convenience for both personal and business transactions.

2. User-Friendly Platform: The service is integrated into the bank's online and mobile banking platforms, making it accessible and easy to use for all customers. The mobile app supports various transactions, including payments and money transfers

3. Secure Transactions: Rokel Instant prioritizes security, ensuring that all transfers are protected and processed swiftly.

4. Additional Services: Beyond transfers, the service allows customers to manage their accounts effectively, offering features such as bill payments, account balances, and transaction histories.

Rokel Save

The Rokel Save product from Rokel Commercial Bank is designed to encourage savings among its customers while offering attractive benefits. Here are the key features of this savings product:

1. Accessibility: Rokel Save accounts can be opened with a low minimum balance, making it accessible to a wide range of customers. This feature aims to promote financial inclusion by enabling more individuals to save.

2. Interest Rates: The account offers competitive interest rates on deposits, allowing customers to earn returns on their savings. The rates are structured to encourage regular deposits and longer-term savings.

3. Flexibility: Customers can deposit and withdraw funds at their convenience, providing them with the flexibility to manage their finances according to their needs.

4. Savings Goals: Rokel Save encourages customers to set and achieve savings goals, making it easier for them to plan for future expenses, investments, or emergencies

5. Digital Banking Integration: With the rise of digital banking, Rokel Save accounts are integrated into the bank's electronic platforms, allowing customers to manage their accounts online or via mobile apps.

6. Security: Funds in Rokel Save accounts are safeguarded, with the bank providing secure transactions and privacy for its customers.

Overall, Rokel Save aims to support customers in building their savings while providing a user-friendly banking experience, which reflects the bank's commitment to enhancing financial services in Sierra Leone.

Rokel Premium (Cheque Book Facility and Gold Card)

Rokel Premium is a suite of banking services offered by Rokel Commercial Bank, primarily targeting individual customers seeking enhanced banking experiences. This package includes the Cheque Book Facility and a Gold Card, which provide several benefits designed to meet the needs of customers in Sierra Leone.

Ø Cheque Book Facility

The Cheque Book Facility allows customers to manage their transactions more conveniently. It facilitates easier payments and withdrawals, enabling clients to issue cheques directly from their accounts. This service is particularly beneficial for individuals and businesses that prefer traditional banking methods over electronic transactions.

Ø Gold Card

The Gold Card is a premium banking card that offers various benefits, such as

- Access to Credit: The card may come with enhanced credit limits, allowing customers to make larger purchases or withdrawals.

- Exclusive Offers: Holders of the Gold Card often receive special offers, discounts, or promotional deals from various merchants, enhancing the overall banking experience.

- Enhanced Customer Service: Gold Cardholders typically enjoy priority service, making their banking interactions smoother and more efficient.

Ø Additional Features

Rokel Commercial Bank emphasizes innovation in its products and services, aiming to provide a comprehensive banking experience that includes features like competitive interest rates, flexible terms, and a robust network of branches across the country.

Rokel Kombra Savings Account

The Rokel Kombra Savings Account from Rokel Commercial Bank is designed specifically for children, allowing parents and guardians to save for their future. Here are some key features and benefits:

1. Child-Centric Design: The account is aimed at fostering a saving habit among children, making it an excellent tool for parents to secure their children's financial future.

2. Access to Other Products: Holders of the Kombra Savings Account can easily access other banking products, such as the Rokel Simkorpor, which is a mobile-based banking platform that enables customers to conduct transactions conveniently from home.

3. Promotion of Financial Literacy: The account encourages financial education and management from a young age, helping children understand the importance of savings.

4. Community Engagement: Rokel Bank engages with the community through initiatives like the "Sick Pikin" project, further promoting a supportive environment for children's financial well-being.

This account aligns with Rokel Bank's mission to empower individuals and families through innovative banking solutions. For more detailed information, you can visit their official website or inquire directly at a branch.

Rokel Kekeh Account

The Rokel Kekeh Account from Rokel Commercial Bank is specifically designed for individuals involved in the transportation sector, particularly those operating tricycles (often referred to as "kekehs"). This account offers several features and benefits aimed at facilitating financial management for drivers and small business owners.

Ø Key Features:

1. Targeted Financial Services: The account caters primarily to tricycle operators, providing them with a banking solution tailored to their unique needs.

2. Flexible Savings Options: Customers can deposit their earnings from daily operations, allowing for better savings management and financial planning.

3. Access to Special Loans: The account holders can benefit from special financing options, such as the Kekeh Loan, which is designed to help them purchase or maintain their tricycles. This financing is crucial for ensuring that operators can sustain and grow their businesses.

Ø Benefits:

- Empowerment: By focusing on a specific demographic, the Rokel Kekeh Account empowers tricycle operators, helping them to formalize their finances and access banking services they might otherwise find challenging.

- Convenient Banking: The account supports a range of banking services, including deposits, withdrawals, and possibly digital banking features, making it easier for operators to manage their finances while on the go.

This account is part of Rokel Commercial Bank's broader initiative to provide inclusive financial solutions to various sectors, demonstrating their commitment to digital transformation and customer empowerment.

Treasury Bills

Treasury Bills (T-Bills) offered by Rokel Commercial Bank are government-issued securities that provide a secure investment option for customers. Here are some key features and benefits:

1. Investment Structure: T-Bills are short-term securities that can be purchased for durations of 90, 180, or 365 days. Customers can choose the tenure that aligns with their financial goals.

2. Minimum Investment: The minimum amount to invest in T-Bills is Le 50 million, making it accessible for customers looking to invest significant amounts.

3. Automatic Bidding: Rokel Bank facilitates the bidding process on behalf of the customer, simplifying the investment procedure. Customers must have sufficient funds in their accounts to cover the investment.

4. Roll Over Options: Upon maturity, customers have the option to roll over their principal amount and accrued interest into new T-Bills, providing a seamless investment experience.

5. Tax Implications: A 15% withholding tax is applied to the interest earned upon maturity, which is paid to the National Revenue Authority (NRA).

6. Requirements: To invest, customers need to be account holders and submit the necessary identification documents, such as a National ID, passport, or voter’s ID.

These features make T-Bills an attractive option

for those looking to secure their funds while earning interest over a short

term. For more detailed information, you can visit Rokel Commercial Bank's

official site.

Rokel Osusu Account

The Rokel Osusu Account from Rokel Commercial Bank is a tailored savings solution designed to support individuals and groups who engage in traditional savings systems like "Osusu" (a form of group savings). It offers features that encourage saving for long-term goals while providing flexibility in deposits and withdrawals. This account is particularly useful for those in informal sectors or small-scale businesses looking to formalize their savings with a trusted bank.

Ø Benefits of the Rokel Osusu Account include:

- Regular contributions from account holders.

- Easy access to funds when needed.

- Interest on savings.

- Available for both individuals and groups, promoting financial inclusion.

This account is part of Rokel Bank's mission to

offer innovative products and improve financial accessibility for underserved

segments of the population.

Foreign Account

Rokel Commercial Bank's Foreign Account service allows customers to hold funds in foreign currencies, typically designed for individuals or businesses that engage in international trade or travel. These accounts facilitate international transactions, providing features like international wire transfers and currency conversion services. Customers can transfer funds globally using IBAN or SWIFT codes, with competitive foreign exchange rates available at Rokel branches. Additionally, these accounts help manage foreign currency risks and ensure efficient cross-border payments.

Let me know if you need more information on this or any other Rokel services!

Safe Custody

Rokel

Commercial Bank's Safe Custody service allows customers to securely

store valuable items such as documents, securities, and other important

possessions in a safe and protected environment. This service is especially

useful for those who need to safeguard assets against theft, loss, or damage.

The bank offers personalized solutions to meet the needs of both individual and

corporate clients, ensuring that all stored items remain confidential and

well-protected

Inward and Outward Swift Transfers

Rokel Commercial Bank's Inward and Outward SWIFT Transfers are services that facilitate international money transfers securely and efficiently through the SWIFT network. Here are the key features and benefits:

Ø Inward SWIFT Transfers:

- This service allows customers to receive funds from overseas accounts directly into their Rokel Commercial Bank account.

- Customers must provide their SWIFT code (ROKCSLFR) and relevant account details to the sender.

- The bank ensures that funds are credited promptly once the transfer is received.

Ø Outward SWIFT Transfers:

- The Outward SWIFT Transfer service enables customers to send funds to international accounts worldwide.

- Customers can send money in different currencies, depending on the recipient's country.

- Competitive foreign exchange rates are provided for currency conversions.

- Secure and efficient processing through the SWIFT network ensures that funds reach their destination safely.

These services are ideal for businesses and

individuals engaged in international trade or travel, providing a convenient

way to manage cross-border payments and remittances.

Mobile Banking

Rokel Commercial Bank's mobile banking services, including their Sim Korpor platform, offer a range of convenient and secure banking solutions accessible via smartphones or even basic mobile phones. Key features include:

1. Account Management: Users can view balances, transaction histories, and manage accounts directly from their mobile devices.

2. Fund Transfers: The service supports both internal transfers within Rokel Bank and external transfers to other banks, making it easy to move money locally and internationally.

3. Bill Payments: Customers can pay utility bills and set up recurring payments, ensuring timely management of regular expenses.

4. Mobile Deposits: With the mobile deposit feature, users can securely deposit checks by capturing their image through the app.

5. Financial Inclusion: The service is designed to extend banking to underserved populations, including informal workers and people in rural areas. For example, okada riders and traders can open accounts with minimal documentation, allowing more people access to financial services without the need to visit a physical branch.

This mobile banking service aims to enhance

financial accessibility and convenience across Sierra Leone by minimizing the

need for physical bank visits.

Letters of Credits

Rokel Commercial Bank offers Letters of Credit (LC) as part of its trade finance services. A Letter of Credit is a financial instrument that guarantees a buyer's payment to a seller will be received on time and for the correct amount, provided that the seller meets the agreed-upon terms and conditions. This service is essential for businesses engaged in international trade, as it helps mitigate risks by ensuring that both parties comply with the terms of the agreement.

Through the LC, Rokel Commercial Bank acts as an intermediary between the buyer and seller, providing financial security and facilitating smooth international transactions. The bank's involvement ensures that payment will be made even in cases of disputes or non-performance, as long as the stipulated conditions in the LC are met.

This service is particularly valuable for businesses looking to expand into global markets while minimizing financial risks associated with cross-border transactions.

Bonds and Guarantees

Rokel Commercial Bank's "Bonds and Guarantees" services provide clients with financial instruments that serve as security for various transactions. These products help businesses and individuals meet contractual obligations or secure loans. Bonds, such as performance or bid bonds, guarantee that a party will meet the terms of a contract, while guarantees can provide assurance to lenders or suppliers that the bank will cover certain financial risks if the customer defaults. This can be especially useful in sectors like construction, imports, or government tenders, where financial assurances are critical for business deals.

Micro Credit and Small-Scale Lending

Rokel Commercial Bank's Micro Credit and Small-Scale Lending services are designed to support individuals and small businesses, particularly those in the informal sector. These loans provide quick access to funds with flexible repayment terms, making it easier for entrepreneurs to manage working capital, expand operations, or invest in new equipment.

The bank offers a streamlined application

process, often leveraging digital platforms to make loans more accessible.

Interest rates are competitive, and loans are tailored to meet the unique needs

of micro and small-scale enterprises. This service is particularly beneficial

for businesses like street vendors, market women, and small shop owners,

helping them grow and stabilize their operations.

Loans and Advances

Rokel Commercial Bank offers a range of Loans and Advances to meet both personal and business financial needs. Their products include:

1. Personal Loans: Rokel provides unsecured and secured personal loans for various purposes like education, medical expenses, and home improvements. Quick loans are also available for immediate cash needs with flexible repayment options and fast approval processes.

2. Business Loans: These include working capital loans for day-to-day operations, term loans for business expansions, and startup loans for new ventures. They offer competitive rates and customized repayment plans based on cash flow needs.

3. Mortgage Loans: Rokel offers home loans and investment property loans with attractive terms and interest rates to help customers purchase or refinance homes.

4. Education Loans: For students, the bank provides loans to cover tuition, textbooks, and living expenses, with flexible repayment options.

5. Auto and Asset Financing: This includes vehicle financing and loans for purchasing equipment, catering to both personal use and business needs.

Rokel emphasizes competitive interest rates, flexible terms, a straightforward application process, and transparent terms with no hidden fees. Their loan services are designed to support personal growth, business expansion, and financial stability.

Agency Banking

Rokel Commercial Bank's Agency Banking initiative is designed to promote financial inclusion by providing convenient banking services in remote areas of Sierra Leone. Through their network of over 200 agency banking locations, the bank allows customers to access various financial services without having to visit a physical branch. These agents are equipped to handle tasks like cash deposits, withdrawals, account inquiries, and bill payments, ensuring that banking services are more accessible to underserved populations.

Additionally, the bank has placed new kiosks in strategic locations across the country to further reduce the distance customers need to travel. These agency banking points utilize secure technology, including two-factor authentication and end-to-end encryption, to guarantee the safety of transactions.

This initiative aligns with Rokel Commercial Bank’s broader mission to drive financial inclusivity and economic growth in Sierra Leone by reaching individuals who might otherwise have limited access to traditional banking services.